Latest Fitness Industry Statistics

Here are topline stats that provide a quick fitness industry overview…

- How big is the fitness industry? Total industry revenue is estimated to be $81.5bn in 2023, down from its peak of $96.7bn in 2019.

- Is the fitness industry growing? Yes the industry is growing again (+7.4% last year) but hasn’t yet recovered fully to its 2019 peak.

- Will this trend continue? The industry has already rebounded dramatically from recent global events and although the next few years may be challenging, there are positive macro signals that it will continue to grow over the long term.

- Industry revenue was originally predicted to hit over $100bn in 2023. But this has been revised downwards as a result of global gym closures.

- However, not all countries were growing prior to 2020. Some markets outperformed others, with the US continuing to grow but others remaining flat. Scroll down for our analysis of predicted growth markets around the world.

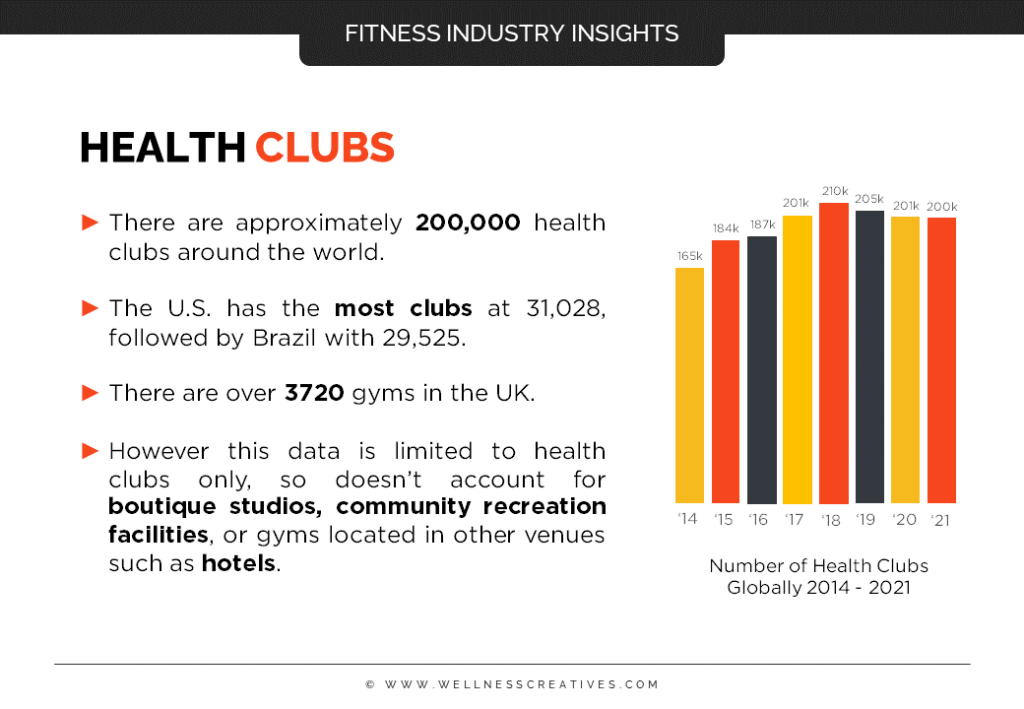

- The industry decreased to approximately 200,000 clubs globally, serving 184 million members. However this data is restricted to health clubs only, so doesn’t account for boutique studios, community recreation facilities, or gyms located in other venues such as hotels. It’s also not representative of the wider workout industry, which continues to grow and encompasses equipment, apps, clothing and wearables.

The next IHRSA report was due to be released in June 2023 but hasn’t yet been published. It will include gym industry statistics from the previous year once available.

Current Industry Trends

There are several fitness trends that have been consistent over recent years. Functional training, HIIT, and a shift towards holistic wellness all look set to stay for the foreseeable future.

While 2021-2022 saw a new wave of digital trends (online and virtual training both made the top 10), 2023 trends reflect a return to previously popular activities. Wearable tech reclaimed the #1 spot, followed by home gyms, outdoor exercise, and free weights.

On-demand fitness services such as Peloton, Aaptiv, and Les Mills’ new offering are taking advantage of improved internet connectivity and streaming capabilities. But they’re also tapping into Millennials’ desires for personalisation, freedom, and experiences over material things.

A Nielsen survey found that 81% of Millennials exercise or would like to, vs only 61% of Boomers. For this reason, Millennials have caught the attention of boutique studios, wearable developers, and equipment manufacturers.

Millennials use fitness apps more than other age groups, with women using them twice as much as men. 46% want as much quantifiable data about their health as possible, and 54% are likely to buy a body-analyzing device.

But Generation Z are rapidly becoming a viable (and relatively untapped) market for fitness businesses. According to a recent Les Mills report, 86% of Gen Z either exercise regularly or would like to start – 5% more than fitness-hungry Millennials. And 72% of those regular Gen Z exercisers train both in and out of the gym, representing opportunities for fitness facilities and online trainers, along with supplement and clothing companies.

Virtual & Online Fitness Stats

Let’s start by clarifying the terms. Although sometimes used interchangeably, online, digital, and virtual refer to different fitness sectors.

- Online – where consumers follow online workout guidance in the form of videos, blog articles, or programs.

- Digital – fitness products and activities that involve digital technology, such as wearables, apps, and interactive heart rate training.

- Virtual – workouts that incorporate virtual reality.

While all three areas had been increasing prior to 2020, it’s online fitness that’s seen the greatest increase since then. Here are some key online fitness industry statistics that demonstrate the growth potential in this segment…

- Prior to the pandemic, the online fitness market was valued at $6bn.

- It’s predicted to grow at 33.1% CAGR.

- This means it would be worth $59bn by 2027.

- Online exercise classes were the #9 fitness trend for 2022 (but dropped out of the top 10 in 2023).

- However, our research shows that the situation is more nuanced than these numbers initially suggest. Our report also reveals that the online workout industry faces similar challenges to bricks and mortar gyms, particularly in terms of retention.

Boutique Fitness Trends

The rise of boutique studios looks set to continue throughout 2023 and beyond, albeit at a slower rate than previously seen.

Now more than ever, people are looking for the sense of community that boutique clubs typically provide. They’re perfectly positioned to service Millennial members, offering personalised training and unique fitness experiences.

Although they charge 2-4 times more than traditional health clubs, they have lower member attrition rates. Their higher-margin operating model is proving popular with fitness entrepreneurs and investors alike, especially in developing markets like China.

Fitness Industry Growth Markets

Despite the rapid expansion and an influx of investment, Asia still has huge potential for growth.

The industry in India is seeing more premium players enter the market but generally struggles to generate revenue outside of memberships.

Despite 3800 clubs and nearly a million members, penetration is only 0.12%. As average incomes increase and the rise of the middle-class becomes reality, penetration rates should rise in line.

Whilst the industry in China has experienced high-level growth across the board, boutique studios are now stealing the march on big-box establishments.

Expansion is happening at lightning-quick speeds, so brands should act quickly to seize opportunities before they disappear. With 2700+ traditional health clubs and increasing studio-style establishments, the biggest growth opportunities are now in tier 3 and 4 cities (or satellites) rather than already saturated hubs.

In Europe, IHRSA have previously highlighted Russia (pre-invasion), Poland, and Turkey as having the biggest potential for growth. It also identified the Middle East, North Africa, and Latin America as being regions with development opportunities.

Fitness Equipment Industry Stats

The fitness equipment industry is estimated to be worth $13.8bn in 2023 and growing at a rate of 3% per year. It continues to mature and consolidate, with the biggest players vying for podium positions. Although cardio and strength machines remain club staples, functional training equipment is seeing the greatest expansion at 47% growth per year!

However, as the boutique studio sector grows, there’s a question mark over how equipment manufacturers should adapt. Studios spend a lot less on equipment than traditional clubs which means less revenue…

Accessories account for the majority of their spending, so cardio and strength manufacturers may need to rethink their product offerings or focus their efforts on other sectors.

Fitness Industry Analysis

There’s no question that the last three years were tough, but based on current stats the future of the fitness industry still looks promising.

As cardiovascular disease and the obesity epidemic continue to rise, the industry will play an increasingly important role in the health of global populations. Fitness businesses that adapt to meet this challenge should find security over the long term.

The statistics shared in this article also provide glimpses as to where the future may take us. As Millennials and Gen Z increasingly drive consumer spending, providing services that appeal to their values will be crucial.

But that doesn’t mean that other generations should be neglected at their expense… The active-aging segment is another growth area that gains immense health benefits from regular fitness activity, so there are huge opportunities in this area too.

(This article is Published by Caroline @ Wellness Creative Co on 3 July 2023, original link: https://www.wellnesscreatives.com/fitness-industry-statistics-growth/#overview)